Many Panama City Beach condo owners who purchased their property from 2004 to 2009 want to refinance their condominiums. Since most banks do not provide loans for the area's condos, consumers do not know where to seek refinancing. Often, lenders, who are usually inadequately versed in condominium financing, give property owners incorrect information. Then, lenders encourage credit worthy condo owners to apply for a refinance, which is later turned down by the underwriters. As a Panama City Beach condominium owner, you need accurate information and knowledgeable lending contacts, so you can get your property refinanced.

This article specifically covers refinancing. If your considering purchasing a condominium, you may want to read our article on Condominium loans in Panama City Beach.

Update: July 2017: Normal condo loans are available at Calypso again.

In October 2016 Calypso was added to the no lend list for the banks that finance condos in Panama City Beach. One of the considerations for providing normal condo loans to gulf front condominiums in Panama City Beach is pending litigation. Any litigation banks feel could severely impact a condominium association can cause condominiums to be added to this list. In October of 2016 the bank that buys the majority of the Panama City Beach condo loans on the secondary market added Calypso to this list.

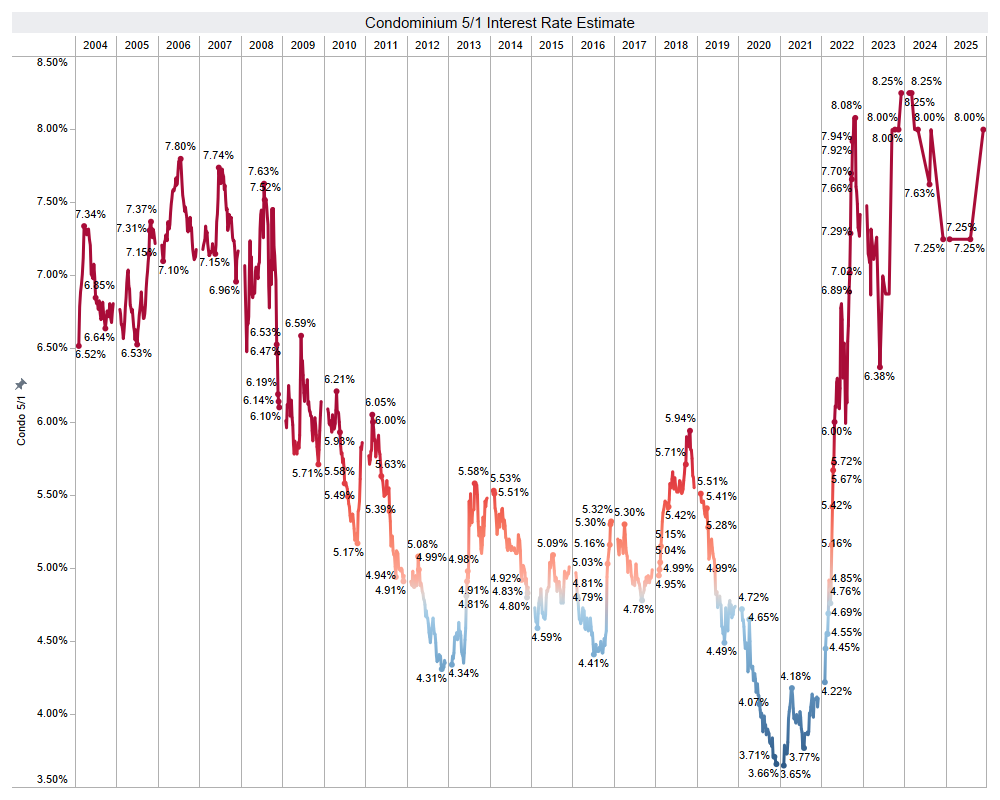

If you are looking for a Panama City Beach condo, loan options may be different than you would expect for a secondary residence. I have written the following article, Condominium loans in Panama City Beach, to explain why. The article's main point is that qualified buyers who put at least 20% down can get a 5-year ARM or a 15-year fixed-rate mortgage. As of February 2017, qualified buyers can expect to get a 5 year arm amortized over 30 years with a rate of roughly 4.5%.

As times change, so do condominium loans in Panama City Beach. The reason is because most buyers are people who purchase these properties as secondary residences or investment properties. The type of loans that banks grant for secondary residences are different from those offered for primary residences especially after the mortgage meltdown of 2008. Before the mortgage crisis, most lenders sold their condominium loans to Fannie Mae, Freddie Mac and any other bank or financial institution that was willing to take them on the secondary market.