Panama City Beach Florida 2024 condo insurance - Some Updates for 2025

Condominium Master Insurance Policy premiums in Panama City Beach have decreased for many condo associations this year. Many buildings are experiencing reductions for the second consecutive year. However, premiums are still notably higher than 2021 levels. More private insurance carriers reentered Florida’s Master Policy Insurance Market for condo associations in 2024. They were likely drawn by premiums that offered an attractive risk-reward balance. This increased competition has contributed to lower premiums.

Panama City Beach Florida 2025 Condo Insurance Update For 2025

Panama City Beach condominiums continue to see relief in master insurance policy costs, with many buildings experiencing an additional 20% reduction in premiums. While these decreases are significant, costs remain notably higher than 2021 levels. A prime example is Ocean Villa, a 125-unit condominium in Panama City Beach. In April 2025, Ocean Villa renewed its master insurance policy, achieving a 21% premium reduction, dropping from $358,000 to $285,000. This trend reflects a stabilizing insurance market, offering hope for condo owners while underscoring the ongoing challenge of elevated costs.

Coral Reef, an 82-unit condominium in Panama City Beach, Florida, saw a 23% decrease in its master insurance policy premium for 2025, falling from $765,000 to $585,717. Despite this reduction, the premium remains high compared to similar buildings. Addressing the underlying… pic.twitter.com/Vdg5Juvtzj

— Christopher Arnold (@panamabeachreal) June 11, 2025

Ocean Villa, a 125-unit condominium in Panama City Beach Florida experienced a 21% reduction in its master insurance policy premium in 2025, dropping from $358,000 to $285,000. Many buildings are seeing comparable decreases this year, though costs remain significantly higher than… pic.twitter.com/1vzPwprIfL

— Christopher Arnold (@panamabeachreal) April 25, 2025

2024 Article

Condo owners in Panama City Beach are confronting a formidable challenge, wrestling with a steep increase in association dues primarily driven by escalating condominium association insurance costs and the need for structural reserve inspections. These insurance rate hikes coincide with private condominium association insurance carriers discontinuing coverage within the state of Florida.

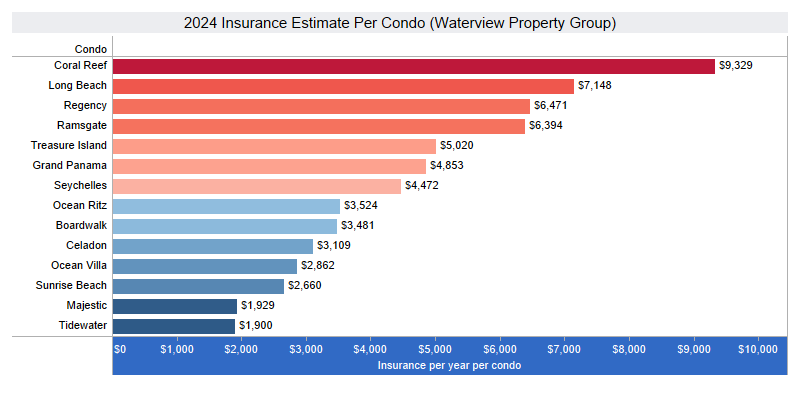

The provided graph draws estimates from condo association budgets and condominium association insurance policies. Its primary aim is to offer condo owners a visual representation of the substantial impact insurance premiums have on their annual association dues.

Many buildings have experienced a remarkable surge, with insurance premiums increasing by a factor of eight compared to rates in 2019. The principal forces propelling the surge in association dues are the costs associated with insurance and structural reserves. While some buildings have adeptly managed these cost escalations, others have seen their dues soar, playing a significant role in recent condo listing price reductions.

Speculating and Exploring the Reasons Behind Varied Insurance Rates in Buildings

Understanding the disparities in insurance premiums among different condominiums has been challenging. In my quest to unravel these differences, I've consulted several insurance brokers. While they have been instrumental in my research, there is still a lack of clarity regarding the forecasting of rates and the rationale behind the pricing strategies of insurance carriers. It appears that the underlying rules governing these rates remain elusive. I've drawn the following conclusions:

Condominiums enjoying lower insurance rates typically have:

- A Hurricane Michael claim that was settled for a small amount.

- They didn’t hire a insurance adjuster to handle their claim.

Conversely, condominiums facing steeper insurance premiums often share common characteristics:

- They have employed a restoration company for repair management.

- Engaged an insurance adjuster for claim handling.

- Are dealing with unresolved claims from Hurricane Michael.

- They are entangled in legal disputes with their insurance carriers that are still unresolved.

- One particular building grappling with structural issues is experiencing significantly higher insurance costs, which seems to be a crucial factor in their inflated premiums.

Insurance Rates: Have they Reached their Peak?

The Case Against the Peak: Why Insurance Rates May Continue to Rise

Seychelles Condominium

Consider the case of Seychelles, a condominium complex with 197 units. In 2023, they were charged $584,000 for their insurance. This year, upon renewing their policy, the premium has escalated to $881,000, representing a significant 51% increase. Such a steep rise suggests that we might be facing another year of considerable insurance rate hikes. If this example is reflective of a broader trend, it indicates that insurance costs are far from peaking and might continue to climb.

Seychelles is a condominium in Panama City Beach with 197 units. In 2023 they paid $584,000 for insurance. In 2024 their rate increased 51% to $881,000. https://t.co/N6yjansvBA pic.twitter.com/iqtxnmAbmz

— Christopher Arnold (@panamabeachreal) January 26, 2024

Cases In Favor of a Peak: Arguments Supporting a Plateau in Insurance Rates

Ramsgate

Ramsgate Harbor Condominium reported that their association insurance policy dropped from $1.1 million in 2023 to $422k, representing a 62% decrease from the prior year. This also marks a 70% decrease from the initial 2024 budget of $1.4 million. This significant reduction… pic.twitter.com/4bwhIz8kpH

— Christopher Arnold (@panamabeachreal) August 13, 2024

Ocean Ritz

There are instances where condo associations have discovered a glimmer of hope. For example, Ocean Ritz (63-unit building), whose insurance renewed in December, managed to secure coverage at a cost 21% lower than that of the previous year. They paid $281,000 in 2023. They just renewed their policy and are paying $222,000 in 2024. They Such cases provide optimism and underscore the dynamic nature of the insurance market.

Treasure Island

Treasure Island is a condominium complex with 263 units. In 2023 they paid $1,859,515 for insurance. In 2024 their rate dropped 29% to $1,320,285.https://t.co/N6yjansvBA pic.twitter.com/6YWH6ahiXR

— Christopher Arnold (@panamabeachreal) January 19, 2024

Panama City Beach condo owners are presently at a unique juncture in their insurance landscape. It's plausible that insurance premiums either peaked last year or may reach their zenith this year. The promise of higher premiums has lured an increasing number of insurance carriers into the market, introducing a potential for welcome competition.

It’s worth noting that the aftermath of Hurricane Michael and its claim history may also impact rates. Most claims stemming from this natural disaster now surpass the five-year mark. Typically, claims remain on record for approximately five years, although this duration can vary depending on the insurance carrier, extending from as few as three years to as many as seven years. Understanding the influence of these timelines is crucial when assessing the long-term insurance outlook.

It is Unlikely Rates go Back to 2019 Pricing

Even if condo association insurance rates remain relatively stable, the repercussions are already evident. It's unlikely that association dues will significantly decrease in the near future. The cost of condo ownership has undergone a reset, and not necessarily for the better.

When will we Have a Better Handle on Condominium Insurance Prices

To gain a more comprehensive understanding of the evolving insurance landscape, we'll need to await developments around June of this year. The majority of condominium policies renew between April and June, offering a pivotal moment for assessments and insights into the insurance landscape.

Panama City Beach real estate, Long Beach Condominium, Condo Association Insurance

- Created on .

- Last updated on .

- Hits: 12645