Panama City Beach Condo Market Overview - February 2024

Market Crash, Correction, or Stability?

A Few Buildings Have Crashed

Market downturns are characterized by a significant decline in property values, often exceeding a 20% drop from peak prices within a year. In Panama City Beach, a handful of condominium buildings have experienced such downturns, primarily because of a series of questionable decisions made by their associations in previous years that are now impacting those particular properties. The Shores of Panama stands out as a notable example, with several articles highlighting ongoing issues for over five years.

Many Condominium Buildings and Floorplans Have Seen a Correction

3-bedroom end unit at Sterling Reef Condominium in Panama City Beach Florida.

— Christopher Arnold (@panamabeachreal) January 15, 2024

$45,264 in rentals on Airbnb and VRBO in 2023

On the market for 248 days

Originally Listed for $845k

December 2023 Price Drop to $780k

Sold $725k pic.twitter.com/IdsCIqPiOD

Adjustments in the market typically involve modest declines, with property values dipping between 10% to 20% from their annual highs. This has been the scenario for many condos in Panama City Beach, where owners grapple with rising association fees and ridiculous lending rates and standards, leading to an approximate 10% to 20% decrease in prices from the previous year's peaks—despite a significant 29% increase the year before.

Several Condominium Buildings and Floorplans haven’t seen price decreases

Nicely upgraded condos at Ocean Villa Condominium in Panama City Beach do sell for a premium.

— Christopher Arnold (@panamabeachreal) February 3, 2024

On the market for 41 days.

Originally Listed for $625,000.

Sold 2/28/23 for $620,000. pic.twitter.com/9GOi6QqaUF

Despite these challenges, some condo units continue to see list prices 10% higher than their most recent sales, resulting in a stalemate with no sales activity as sellers hold out for higher prices and buyers show reluctance towards paying a premium over a comparable sale less than six months ago.

Panama City Beach Condos for Sale

A Delicate Balance of Supply and Demand

Supply Dynamics

New condominium developments are at a standstill. Developers can’t build new condominiums. Over 75% of condo owners having maintained ownership since 2021. A notable portion of these owners do not have mortgages, and for those who do, most are locked into low interest rates ranging from 3-4%. Buyers obtaining mortgages since 2021 have faced stringent qualification criteria, leading to a market devoid of distressed sellers.

Demand Trends

Gulf Front 2 bedroom upgraded condo at Edgewater in Panama City Beach.

— Christopher Arnold (@panamabeachreal) January 25, 2024

On the market for 116 days

Originally Listed for $770,000

Sold 1/4/23 for $750,000

Condos upgraded correctly bring a nice premium. Many buyers do not want the headache of remodeling a condo. pic.twitter.com/tbq8LDtdiP

Despite obstacles such as elevated interest rates, strict lending criteria, and the recognition that the costs associated with condo ownership are considerably higher, there is still a steady flow of buyers prepared to acquire properties at sensible prices. The rate at which the market is absorbing new listings has notably decreased, reaching its lowest point since 2010. Nonetheless, this represents a healthy volume of sales from well-qualified new buyers.

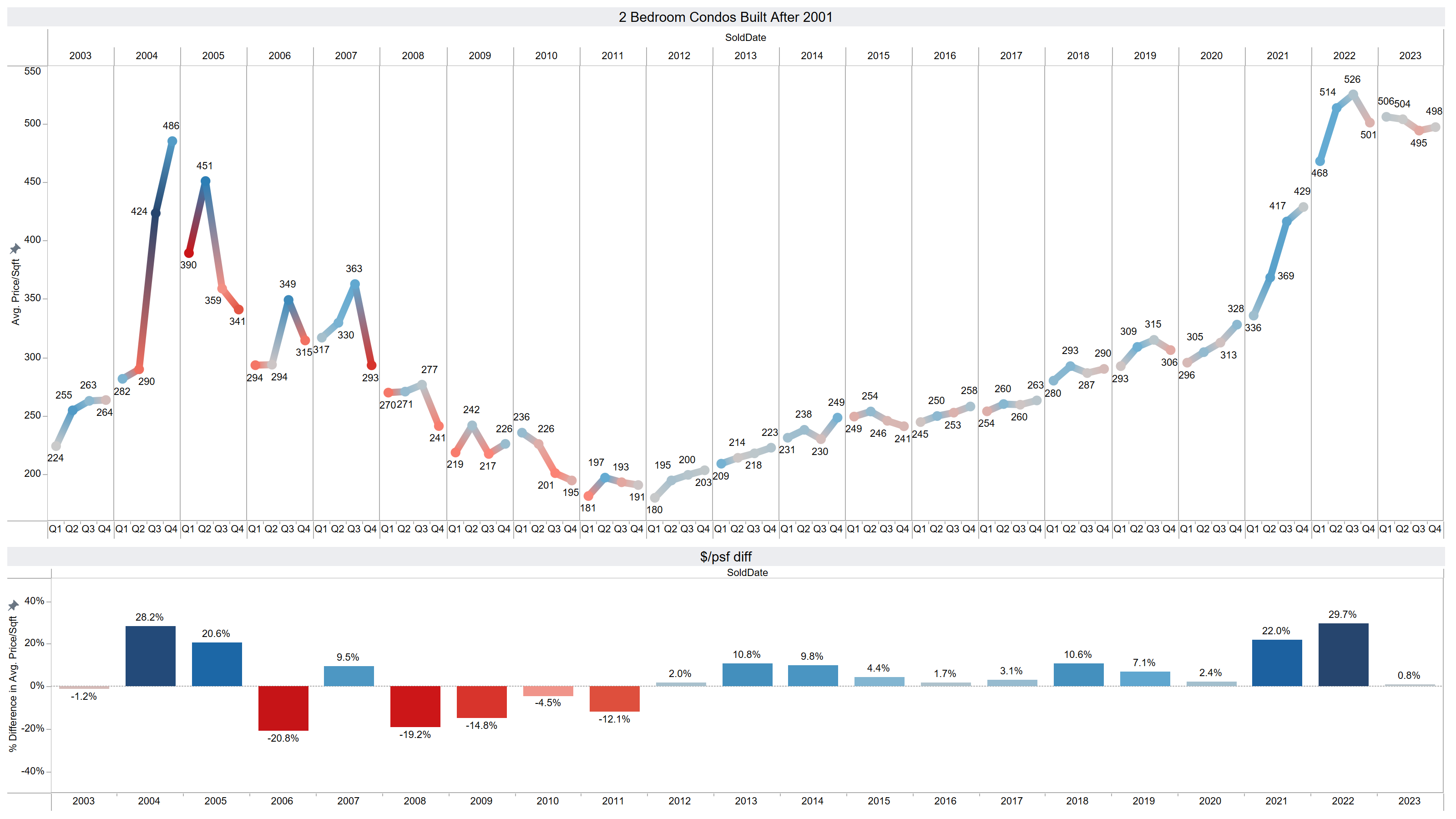

Condo Price Per Square Foot update

In 2023, condo prices saw a marginal increase of 0.08%, following a substantial 29% rise in 2022. This stabilization is attributed to various challenges, including soaring ownership costs and tighter lending criteria, with interest rates climbing from 4% to 8%. Nevertheless, the market hasn't witnessed a significant influx of listings. Price reductions were largely attributed to initial unrealistic asking prices.

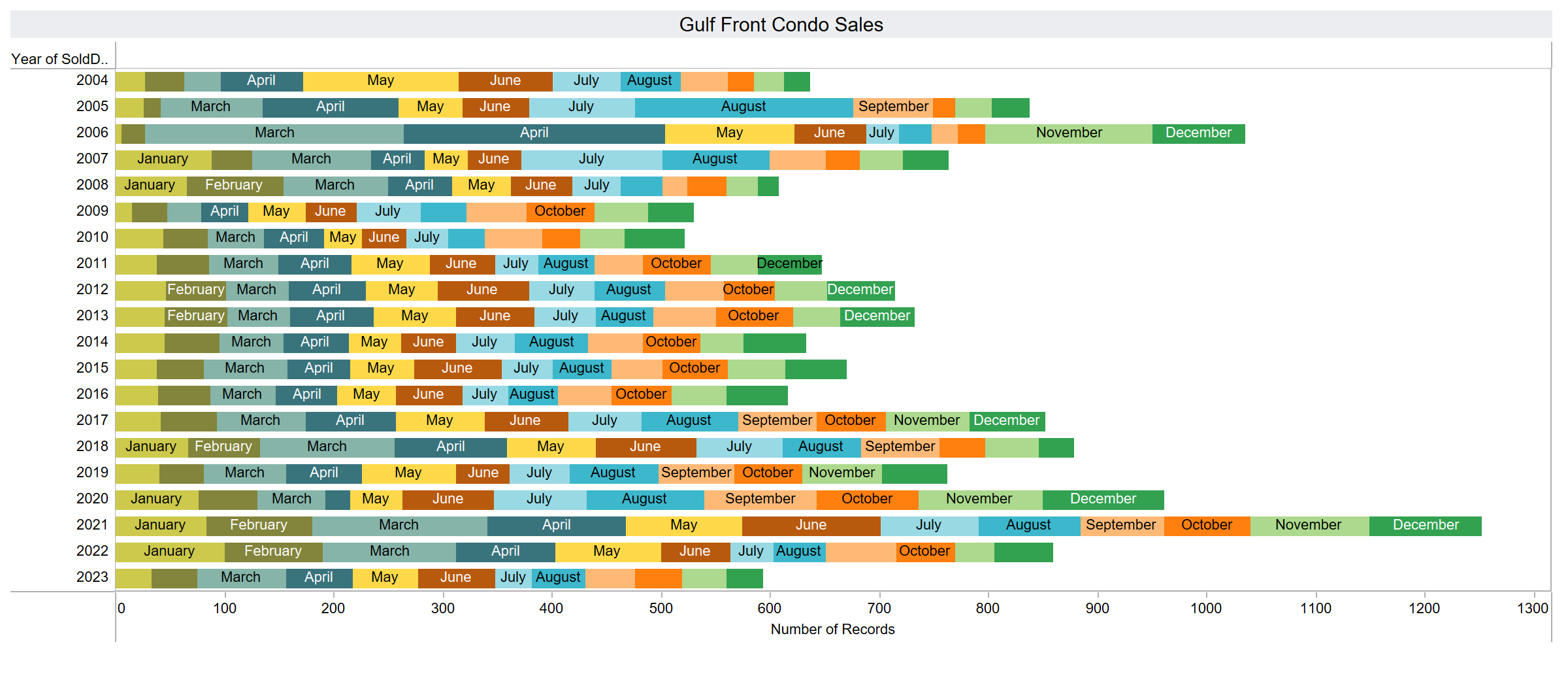

Condo Sales Volume

In 2023, the sales of condos amounted to 596, hitting the lowest level of sales volume observed since 2010. This decrease highlights the prevailing conditions within the market. Even amidst challenges like rising interest rates, rigorous lending standards, and an awareness of the increased costs of owning a condo, there remains a consistent demand from buyers ready to purchase properties at reasonable prices.

Factors Driving The Pricing of Panama City Beach Condos for Sale

Rising Condo Association Costs

Panama City Beach Grand Panama Condominium association dues go up 28% in 2024 for the two-bedroom floorplan.

— Christopher Arnold (@panamabeachreal) December 22, 2023

You will find a growing list of Panama City Beach association dues analysis here:https://t.co/EgWu6Mc0fg

The largest contributing factors are rising Insurance costs and… pic.twitter.com/vMYl2bp9fM

The inflation of condo association expenses is universal, primarily driven by insurance costs and the impending Structural Reserve law. While many buildings are well-prepared to adapt to these changes, a few face large potential special assessments that could impose significant financial burdens on their residents in the coming years. In this article (Panama City Beach Florida Condo Association Dues 2024), I've compiled a history of association dues from a selection of condominium associations, covering the past several years.

Treasure Island is a condominium complex with 263 units. In 2023 they paid $1,859,515 for insurance. In 2024 their rate dropped 29% to $1,320,285.https://t.co/N6yjansvBA pic.twitter.com/6YWH6ahiXR

— Christopher Arnold (@panamabeachreal) January 19, 2024

Strict Condo Lending Requirements

Tighter lending standards have progressively restricted condo purchase financing options. Presently, buyers targeting condos valued at $767k or less must navigate limited loan alternatives, primarily adjustable-rate mortgages requiring at least a 20% down payment. Interest rates for these loans exceed 8% for condos below the $767k threshold and 7% for those priced higher. You can see more details here: Condo Loans in Panama City Beach.

Advice for Prospective Buyers and Sellers

For Buyers

Stay Informed About Your Targeted Buildings

It's crucial to be well-informed about the condominium buildings you're interested in. Issues such as inadequate management of Condominium Association Insurance or Structural Reserve Requirements could lead to significant special assessments to correct the association's financial standing.

The Reality of Cash Flow and Financing

Prospective buyers aiming to find a condo in Panama City Beach that can generate positive cash flow with an 80% mortgage will find this goal unattainable. The market has shifted, and the era when such investments were feasible has passed. Despite nearly 600 condos being sold last year, the expectation for a condo to cash flow under these conditions has been unrealistic since 2020.

For Sellers

Partner with Knowledgeable Real Estate Professionals

The market for condos remains active. If your property is not selling, it might be time to delve into the reasons why. Properties that have been enhanced with thoughtful upgrades and decor often sell at a higher value. It's important to have a clear understanding of your property's real market value.

Diligently Evaluate Incoming Offers

Should your agent or broker lack expertise in evaluating incoming offers and vetting lenders, you may repeatedly encounter contracts falling through.

Questions?

Feel free to contact me.

Christopher Arnold

Broker

850-625-5113

Shores of Panama, Panama City Beach real estate, Panama City Beach condos for sale, Ocean Villa, Real Estate Market Updates

- Created on .

- Last updated on .

- Hits: 1297