November 2019 Market Update

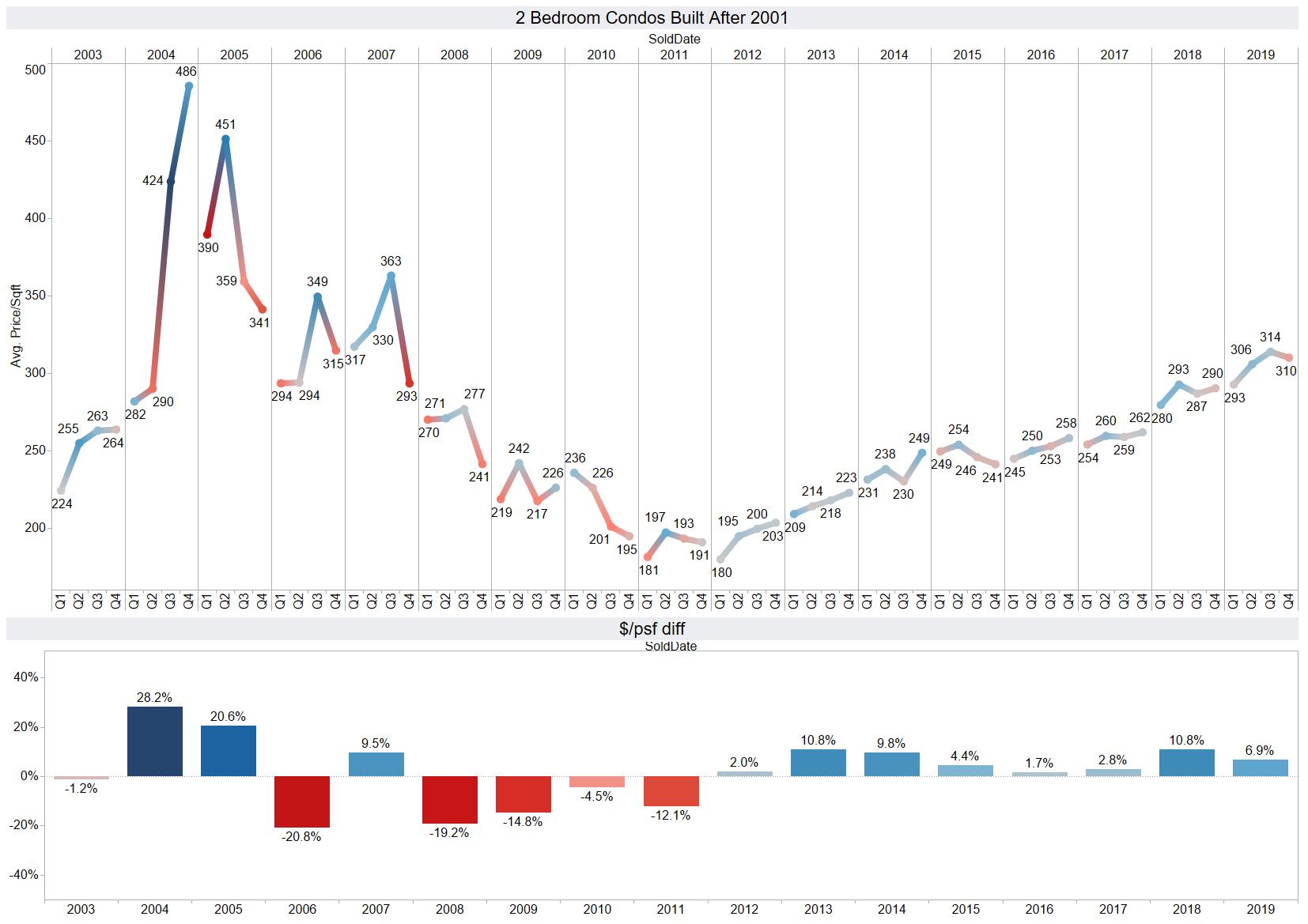

Following an increase of 10% in 2018, we are already up by 6.9% in 2019. Compared to the same period last year, the sales volume is down by 21%, but still higher than we expected. Since 2011, we have been able to see a healthy balance with our sales volume performance. I am not seeing any signs of what would be considered as a ‘real’ pre-construction supply. As such, sales price increases and a steady volume all reflect the fact that Panama City Beach is continuing to improve, mature, and grow as a vacation destination.

Panama City Beach Condo Sales

Pricing is up 6.9% for the year. Do not read too much into the 4th quarter numbers because at the point of writing this, we are only one month into the quarter. Overall, the average prices of condos in Panama City Beach and individual floor plans continue their twelfth consecutive year of gains. The area continues to grow, and mature. You can thank St Joe for the Bay Parkway or “Back Back Beach Road” project, and the new Panama City Beach Sports Complex. While the Front Beach Road CRA project appears to be trying to set a world record for “longest time to complete one segment of road”, you can see some minor progress in Segment Two. The city has only been working on Front Beach Road Segment Two since 2016.

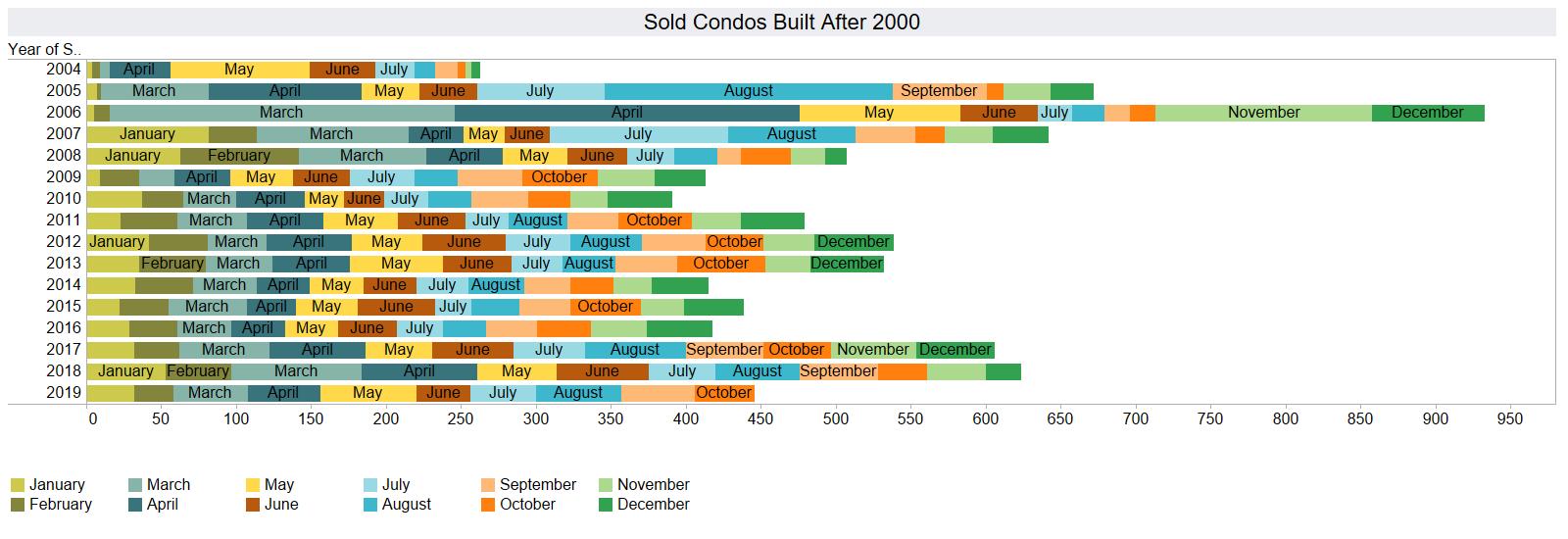

We also have the Shores of Panama Auction taking place in December. This should add some volume we were not expecting at prices significantly below the average 2-bedroom per square foot price. Shores of Panama has sold at prices well below market averages for years. You can dig further into this in these two recent blog articles:

Condo Sales Volume

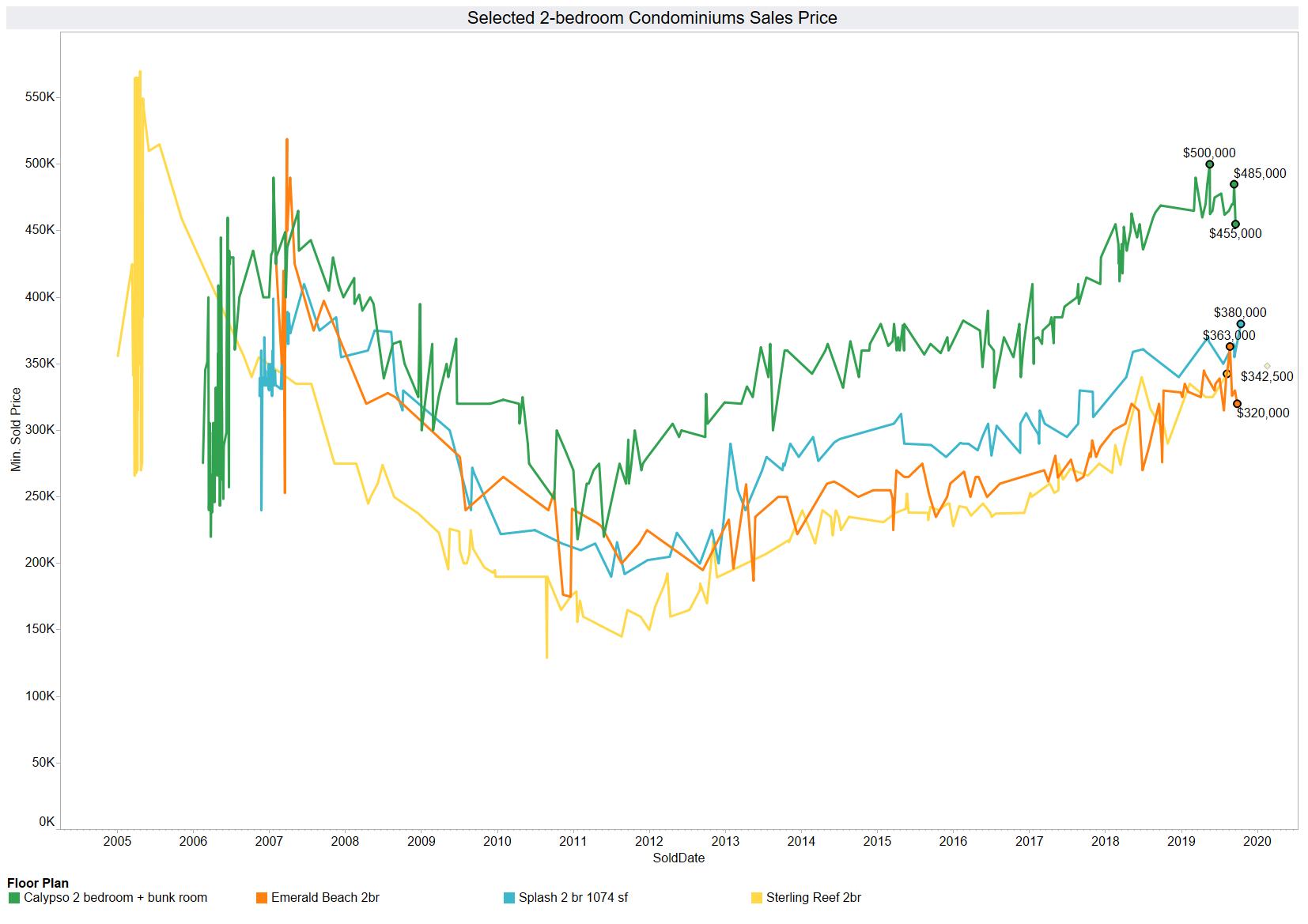

Selected Condominiums

Sales Prices

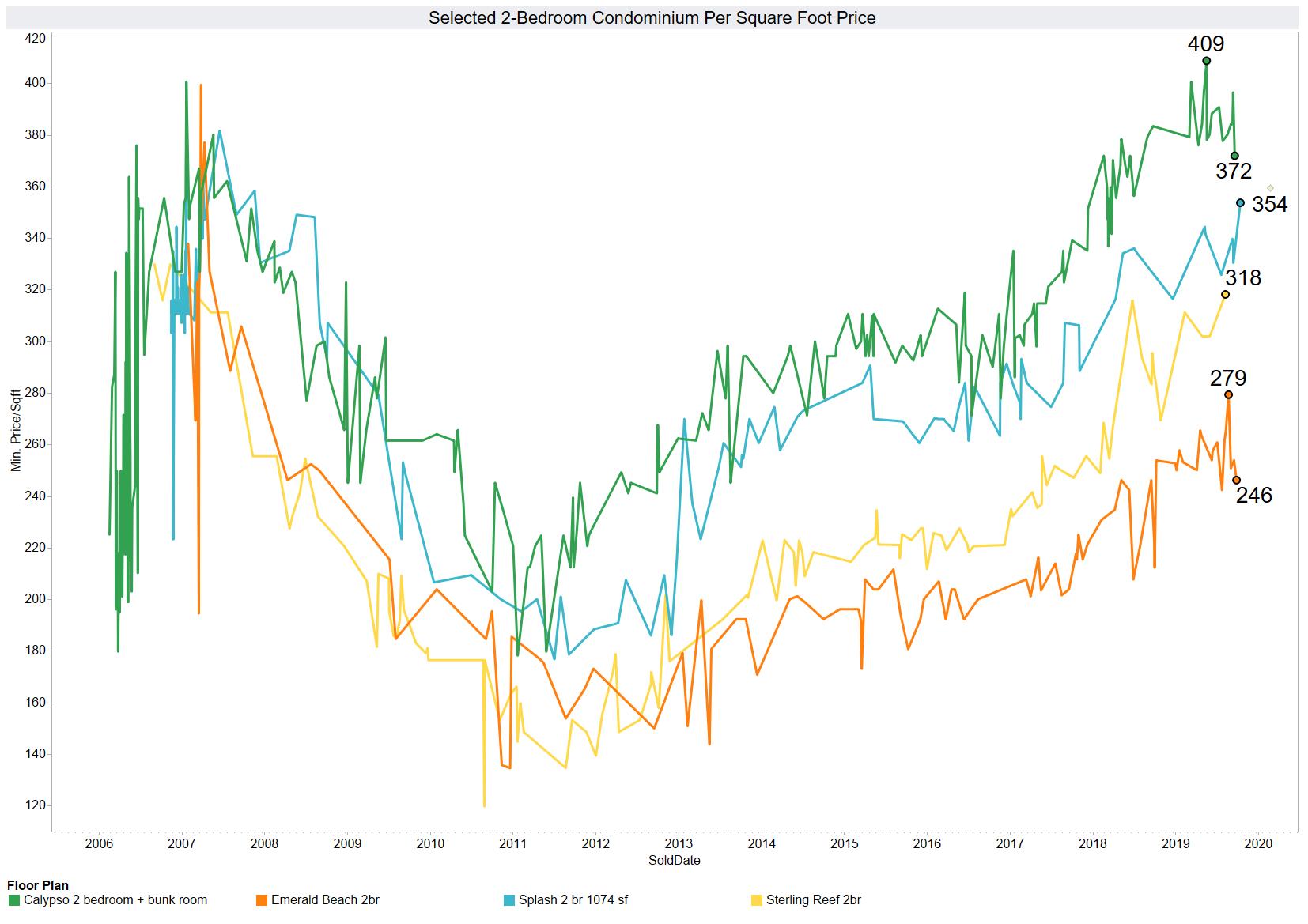

Price Per Square Foot

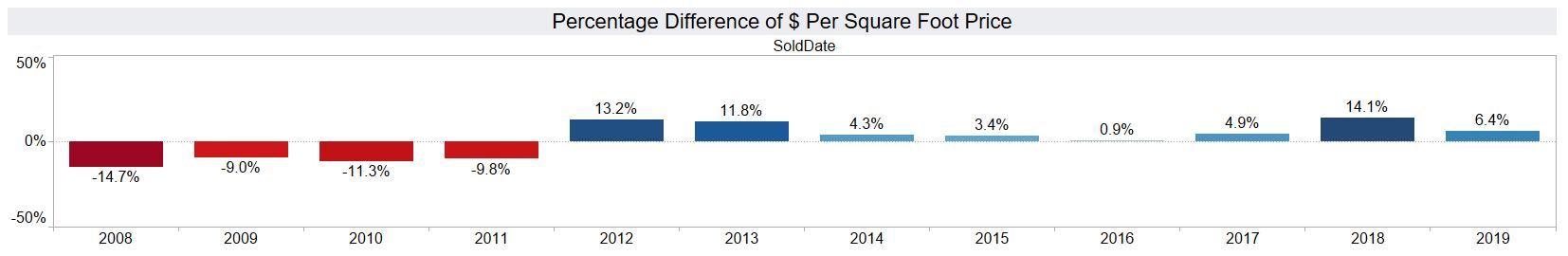

Calypso Is Up 6.4%

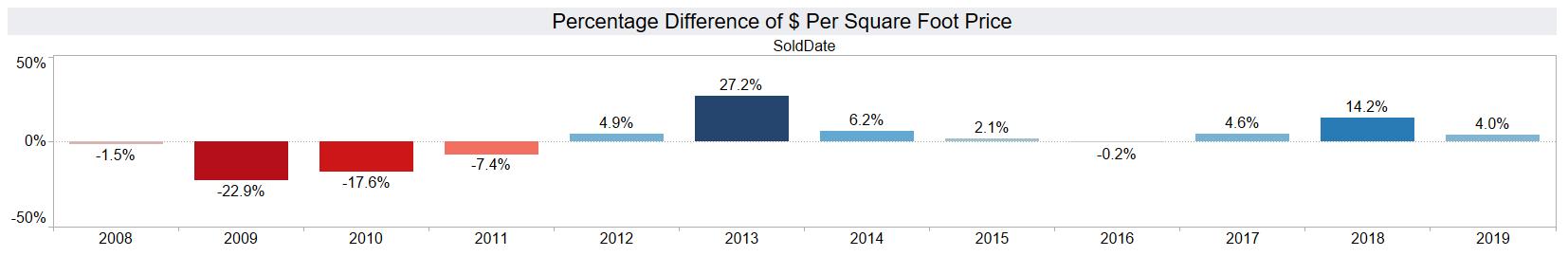

Splash Is Up 4%

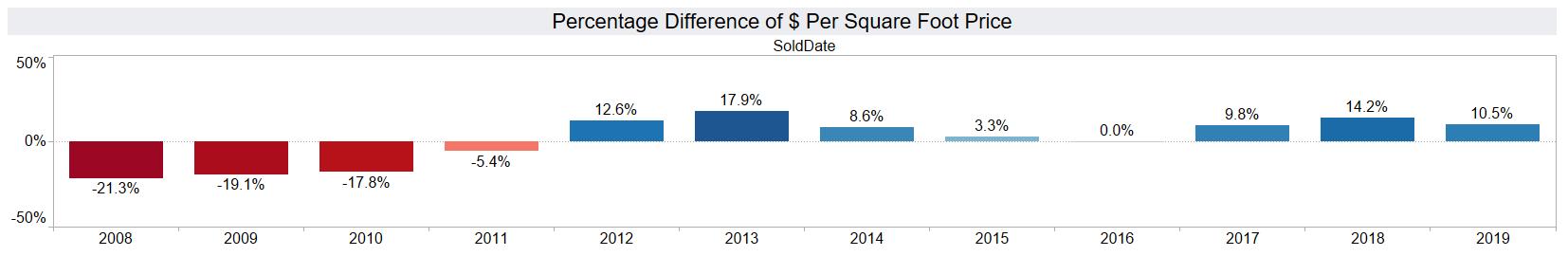

Sterling Reef Is Up 10.5%

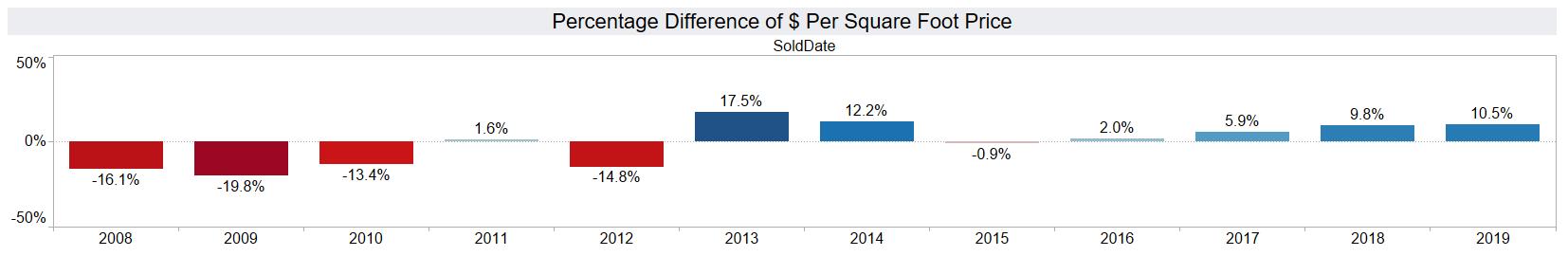

Emerald Beach Is Up 10.5%

Condo Lending Starting to Loosen Up

Lenders are slowly adding Condominiums that Freddie Mac is providing 10% down financing

The secondary market for condo loans is slowly opening up. This is the very beginning of this process. Freddie Mac is the first secondary market banks can sell their loans to. Since the Financial crisis of 2007–2008 most condo loans were kept on the books of the bank that provided the mortgage. Almost all of these had a 20% down loan requirement. This is the first time since financial crisis a sizable secondary market has opened with 10% down.

Freddie Mac Current Condominium Lending Requirements For 10% Down Loans for Second homes and Investment Properties

- Condo must have more than 10% of the association’s annual budget in reserves

- Condo Association Budget must not receive revenue from a rental desk

- The entire condominium project and any master association must be complete and not subject to any additional phasing

- At least 75% of the total units in the project have been conveyed to the unit purchasers

- Any Litigation must not be expected to exceed 10% of the annual Condominium Association Budget

Panama City Beach Condos that currently qualify for 10% down Freddie Mac Financing

- Celadon

- En Soleil

- Grand Panama

- Ocean Villa

- Palazzo

- Sterling Beach

- Sunrise Beach

- Tidewater

- Watercrest

This is the Beginning. This is not a repeat of 2007-2008, yet.

Before the financial crisis there were a number of secondary markets open to banks lending on Panama City Beach Condos. Banks could take the loans on condos and resell them. Lending requirements were minimal. You could:

- state your income without providing documentation

- own as many condos as you wanted

- there were easy workarounds for Debt-to-Income requirements

- get a loan with 0% down

We are nowhere near that. Everyone still needs to meet Debt-to-Income requirements, document their credit worthiness, and meet a host of other criteria. In short, the speculators will still not be able to enter the market as Freddie Mac starts expanding its 10% down lending requirements.

If a secondary market shows up that provides a workaround to the Debt-to-Income requirement, 0% down, or easy access to cash out refinancing; that would change things. That is when everyone should stand up and start paying attention. That would likely set us up for our next financial crisis in the years that follow.

Condo Flipping in Panama City Beach

Don't Trust Rental Projections

Calypso Condominium, Real Estate Market Updates, Panama City Beach condos for sale, Panama City Beach real estate, Splash Condominium

- Created on .

- Last updated on .

- Hits: 9274