Panama City Beach Condo Market Overview - August 2024

Market Crash, Correction, or Stability?

Some buildings and floor plans have remained stable, showing no signs of pricing stress or reduction. Other buildings are experiencing a significant price drop, with values falling back to 2021 levels. The average price per square foot tries to balance a very segmented market, but it can be misleading. Here are a few examples:

- Shores of Panama is selling at $400 per square foot

- Treasure Island is selling at $434 per square foot

- Ocean Villa is selling at $458 per square foot

- Long Beach Condominium is selling at $460 per square foot

- Gulf Crest Condominium is selling at $550 per square foot

- Calypso Condominium is selling at $630 per square foot

Panama City Beach Condos for Sale

Update September 6, 2024:

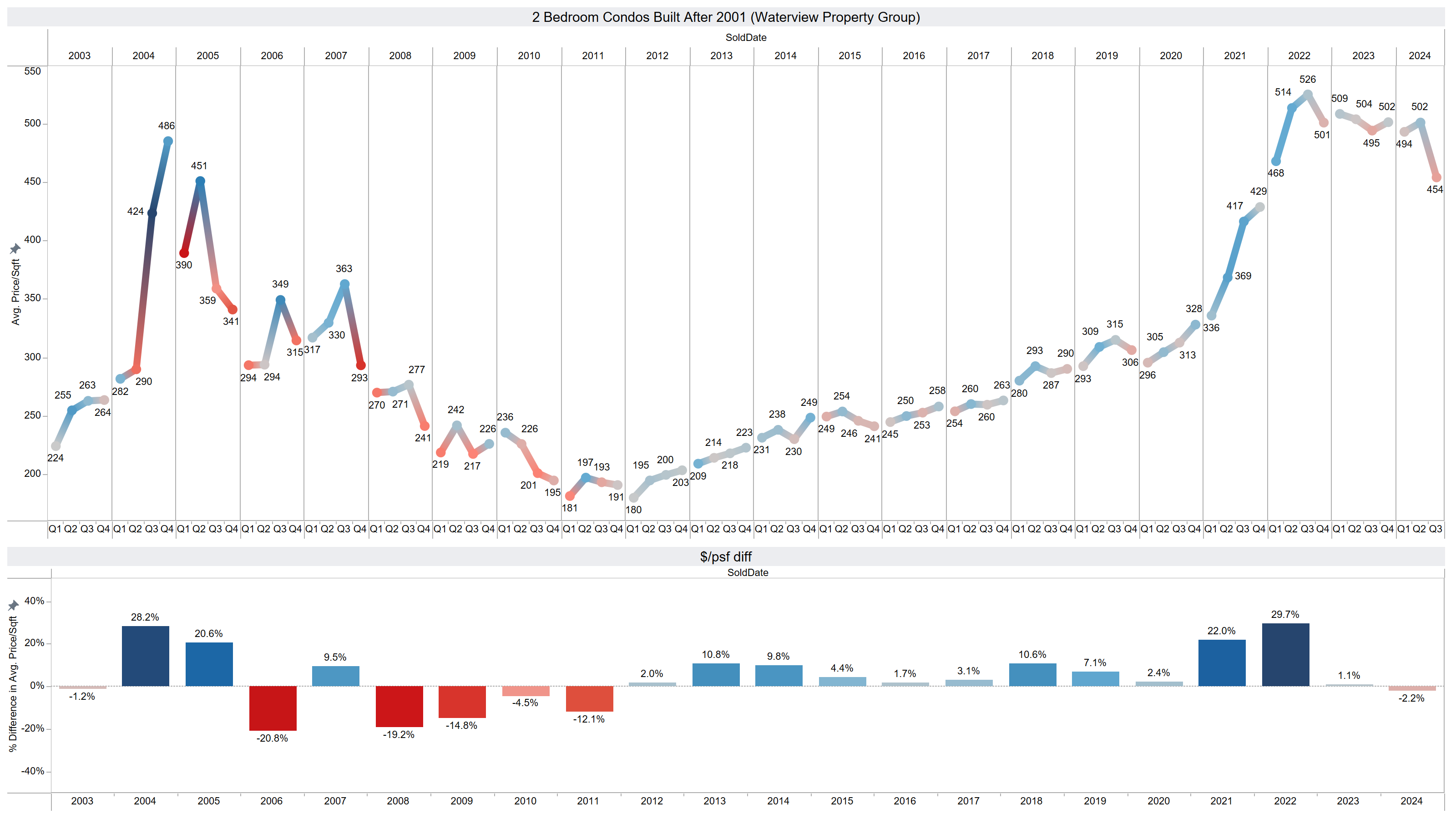

Panama City Beach Condos Prices Collapse 10% in one Quarter

The average sale price for the year is down 2.2%, but this figure is somewhat misleading. Sales in the third quarter are down 10% compared to the second quarter. However, we are now seeing strong absorption rates in several buildings and floor plans. I will provide more details on this in the upcoming September Market Update.

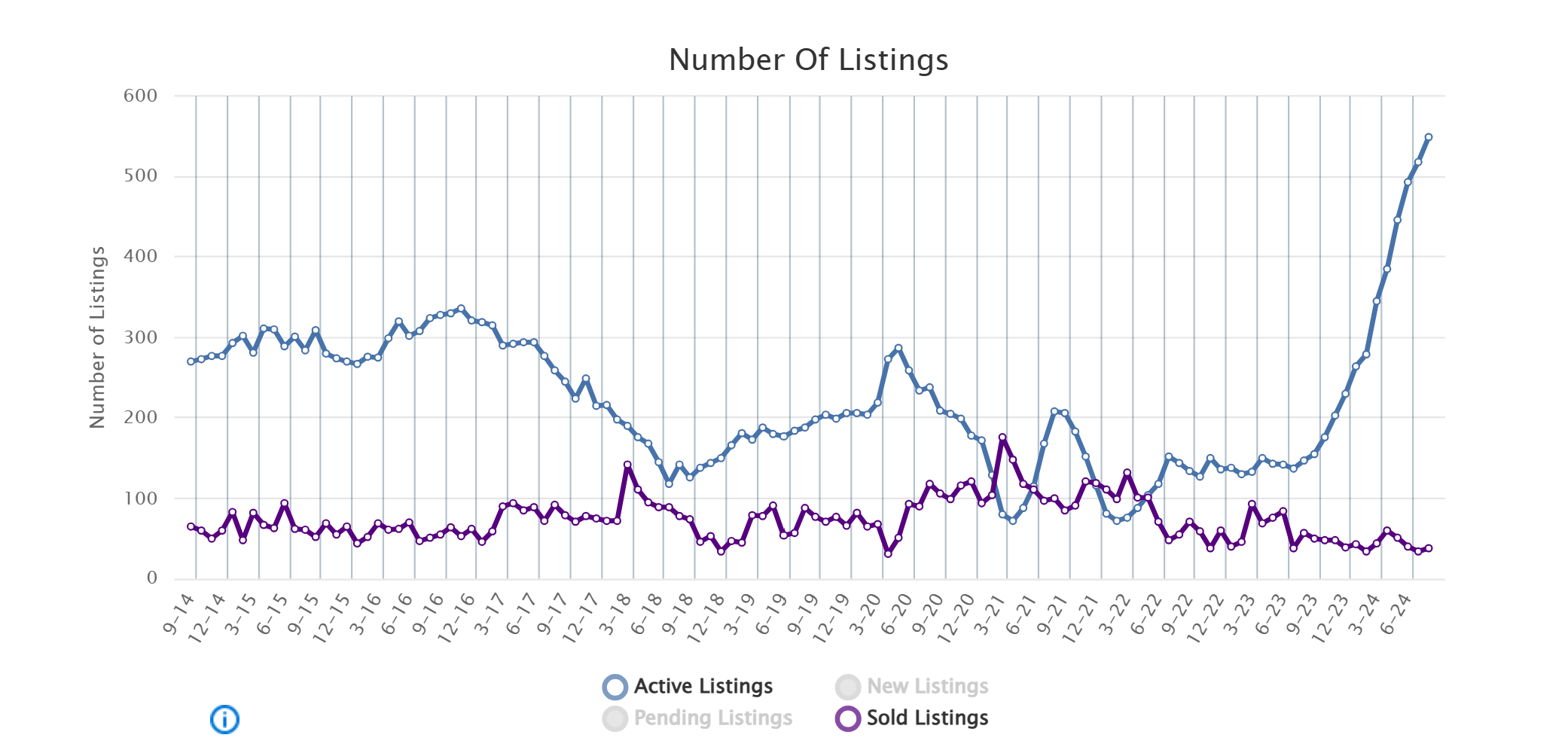

Panama City Beach Florida Condo Supply Hits Highest Level in 20 years as Sales Slow Amid High HOA, Insurance Costs

This chart is informative, but it's important to understand that roughly 30% of the condos for sale are priced at least 10% higher than other identical floor plans currently on the market.

Original Article:

A Few Buildings Have Crashed

There isn't a standardized definition for a pricing correction, but it is commonly understood to mean a drop of more than 10% but less than 20%. A decline of 20% or more is often referred to as a crash.

At Shores of Panama, a two-bedroom floor plan has experienced a 30% drop from its peak sale prices in 2022. The Shores of Panama stands out as a notable example, with several articles highlighting ongoing issues for over five years.

A two-bedroom unit at Shores of Panama Condominium in Panama City Beach sold for $415,000, significantly below its original asking price of $550,000. The property was on the market for 123 days before selling at a $135,000 discount, representing a drop of over 24%. In 2022,… pic.twitter.com/SWipvQtTDC

— Christopher Arnold (@panamabeachreal) July 19, 2024

Many Condominium Buildings and Floorplans are Blurring the Lines Between a Crash and Correction (15-25%)

Market adjustments typically involve modest declines, with property values dipping between 10% to 20% from their annual highs. This year, however, seems to blur the lines between a crash and a correction, as many buildings and floor plans are experiencing price drops of 15% to 25%.

Celadon Condominium is a good example. A one-bedroom floor plan that sold for $495k, $490k, and $480k in 2022 and 2023 recently sold for $385k, marking a 22% drop from its peak price.

We are back to 2021 pricing. This one bedroom at Celadon Condominium in Panama City Beach just sold for $385k. It happened after 16 days on the market for $15k less than the original asking price. It sold for $350k in 2021.https://t.co/XVEU09Ko5R#PCB #panamacitybeach pic.twitter.com/qkMEd4W2rY

— Christopher Arnold (@panamabeachreal) July 4, 2024

Several Condominium Buildings and Floorplans haven’t seen price decreases

A market correction is not evident across all condominiums in Panama City Beach. Some units are maintaining their previous sales prices, while others are experiencing sales that exceed a 10% increase from the prior year.

This three-bedroom at Sterling Beach Condominium in Panama City Beach just sold for $950k. It happened after 117 days on the market for $50k less than the original asking price. It sold in September of 2022 for $850k. This condo has a several larger three-bedroom floorplans.… pic.twitter.com/8iKZGmMdkZ

— Christopher Arnold (@panamabeachreal) July 6, 2024

A two-bedroom plus bunk unit at Calypso Condominium in Panama City Beach recently sold for $759k. It was listed for just two days before selling at the full asking price. Calypso remains one of several condominiums showing no signs of declining prices or demand.… pic.twitter.com/cOzWPD0gW0

— Christopher Arnold (@panamabeachreal) July 9, 2024

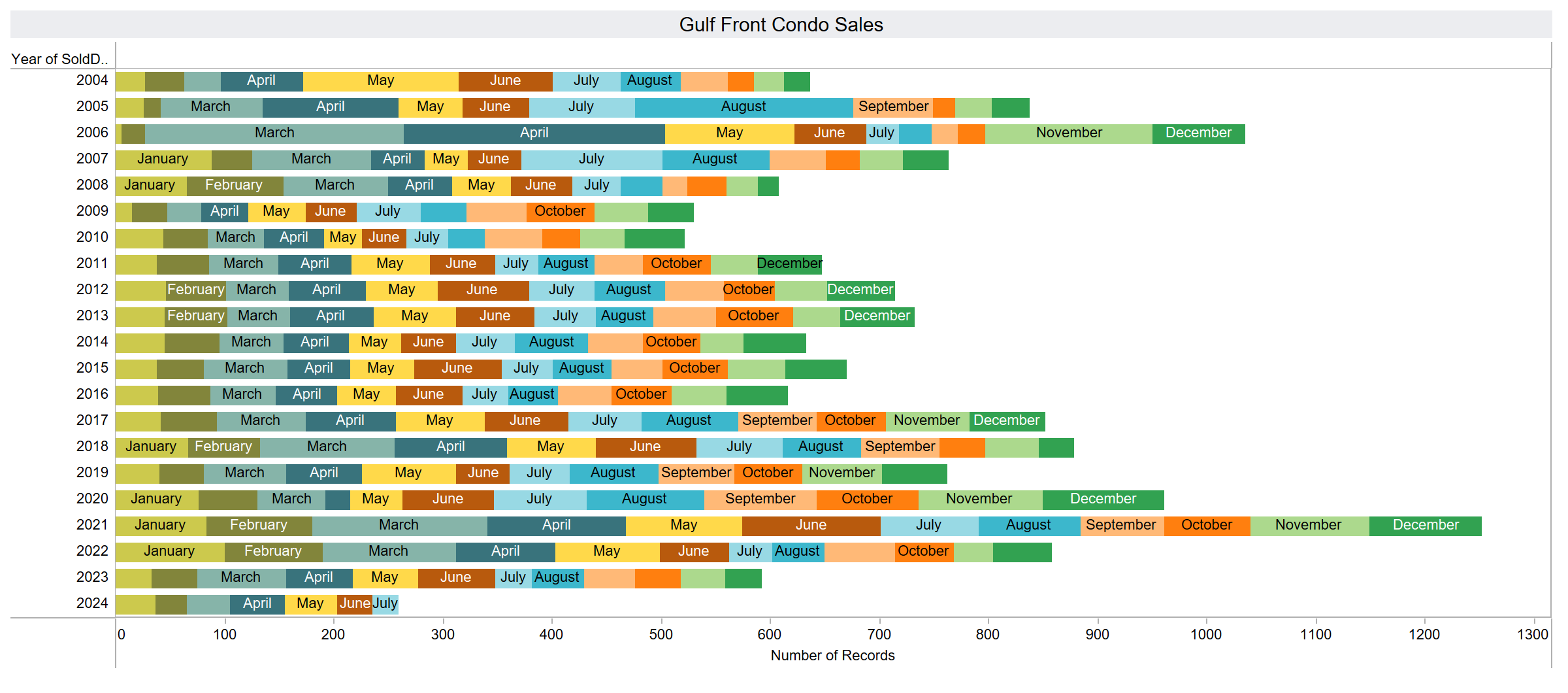

Condo Sales Volume

In 2023, condo sales totaled 596, marking the lowest sales volume since 2010. With only 260 condos sold in the first seven months of this year, sales volumes are slightly below the lowest level seen in 20 years, which was in 2009. Despite challenges such as rising interest rates, stringent lending standards, and awareness of the increased costs of condo ownership, there remains a reduced but consistent demand from buyers ready to purchase properties at reasonable prices.

Factors Driving The Pricing of Panama City Beach Condos for Sale

Supply Dynamics

Developers are unable to build new condominiums, freezing the supply. Over 75% of condo owners purchased their properties well before the 20% price increase of 2021. This year, I have seen only one foreclosure and no short sales. Recently, several buildings and floor plans have significantly reduced prices to create an absorption rate.

Condo Association Costs

The 2024 budgets for many condominiums saw significant increases. This was primarily driven by rising insurance costs, the impending Structural Reserve law, and Milestone Inspections due for condominiums 25 years or older. Some buildings are more prepared than others. Many associations were pleasantly surprised when condominium insurance prices came in significantly lower than expected and budgeted for this year.

Ocean Villa is a condominium in Panama City Beach, Florida, with 125 units. In 2023 they paid $475,285 for insurance. In 2024, their rate dropped 24% to $357,803, which means each individual condominium pays $2,862 annually in association dues towards insurance. Many condominiums… pic.twitter.com/R6NJMr9vnI

— Christopher Arnold (@panamabeachreal) July 23, 2024

In-Depth Articles on This Topic

- Panama City Beach Florida 2024 condo insurance

- Panama City Beach Florida Condo Association Dues 2024

Strict Condo Lending Requirements

Tighter lending standards have progressively restricted condo purchase financing options. Presently, buyers targeting condos valued at $767k or less must navigate limited loan alternatives, primarily adjustable-rate mortgages requiring at least a 20% down payment. Interest rates for these loans exceed 8% for condos below the $767k threshold and 7% for those priced higher. You can see more details here: Condo Loans in Panama City Beach.

Advice for Prospective Buyers and Sellers

For Buyers

Stay Informed About Your Targeted Buildings

It's crucial to be well-informed about the condominium buildings you're interested in. Issues such as inadequate management of Condominium Association Insurance or Structural Reserve Requirements could lead to significant special assessments to correct the association's financial standing.

The Reality of Cash Flow and Financing

Prospective buyers aiming to find a condo in Panama City Beach that can generate positive cash flow with an 80% mortgage will find this goal unattainable. The market has shifted, and the era when such investments were feasible has passed. Despite nearly 600 condos being sold last year, the expectation for a condo to cash flow under these conditions has been unrealistic since 2020.

For Sellers

Partner with Knowledgeable Real Estate Professionals

The market for condos remains active. If your property is not selling, it might be time to delve into the reasons why. Properties that have been enhanced with thoughtful upgrades and decor often sell at a higher value. It's important to have a clear understanding of your property's real market value.

Diligently Evaluate Incoming Offers

Should your agent or broker lack expertise in evaluating incoming offers and vetting lenders, you may repeatedly encounter contracts falling through.

Questions?

Feel free to contact me.

Christopher Arnold

Broker

850-625-5113

Real Estate Market Updates, Ocean Villa Condos for Sale, Panama City Beach condos for sale, Panama City Beach real estate, Shores of Panama

- Created on .

- Last updated on .

- Hits: 5828